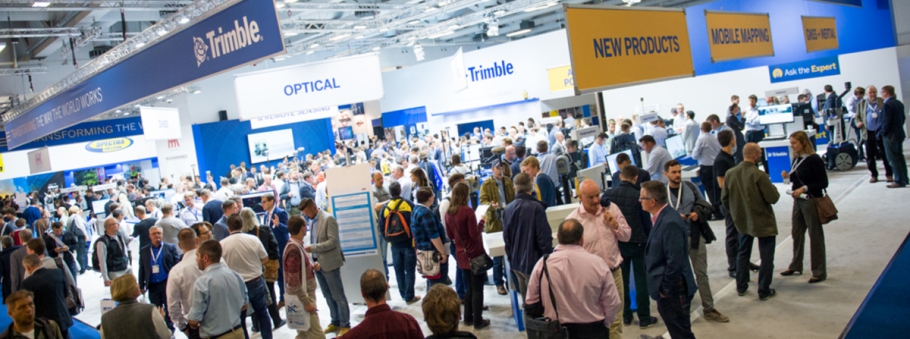

I have now returned home from attending Intergeo in Berlin. I must admit that, with many of our industry’s vendors having announced new hardware in 2016, this year may have felt a little flat in terms of excitement, with no shiny new sensors on display.

However, regular readers will know though that it is not a dramatically smaller or faster sensor that will excite me, but instead the tweaks in a workflow that improve data delivery to the customer. With that in mind, here are two highlights from this year’s Intergeo.

1: A UAV sensor designed with a purpose

A personal gripe of mine has been the UAV industry’s repurposing of sensors, specifically those that are selected mainly based on cost rather than being fit for purpose. Most commonly, we see this when lidar sensors that were originally designed for the automotive industry are used for survey applications.

A personal gripe of mine has been the UAV industry’s repurposing of sensors, specifically those that are selected mainly based on cost rather than being fit for purpose. Most commonly, we see this when lidar sensors that were originally designed for the automotive industry are used for survey applications.

In an earlier post, I emphasized how UAV lidar use is best applied to applications involving linear survey and mapping activities that take place in highly vegetated and/or steep mountainous environments. While at AUVSI earlier this year, I blogged about how one of the sensors from the start-up community that that I liked was from Z-Senz, which deployed a 2-axis scan pattern to focus all the points collected on the ground. This is particularly important for efficient survey operations, as it increases point density and vastly reduces redundancy in onward processing. Just think, how often is what’s being mapped located above the UAV platform?

It is for this reason that I was pleased to see the RIEGL miniVUX-1DL announced at this year’s Intergeo. While SPAR3D Editor Sean Higgins has already published a news article on its specifications, I am more concerned with the implications. I am excited to see an established lidar manufacturer designing a professional system specifically for UAV mapping.

Unlike other sensors in RIEGL’s VUX range, which include spinning 360-degree scanner heads that can be mounted on both mobile and airborne platforms, the miniVUX-1DL features a circular downward facing scan pattern. As such, it is obvious that the miniVUX-1DL is not only designed for airborne UAV survey, but also the application of corridor mapping (such as vegetation management in transmission corridors) where the case for lidar has clear and tangible business drivers.

With a swath width of 23o, the miniVUX-1DL offers a narrower corridor of data than the 40o of useable data that is typically offered by a 360-degree scanning system. However, within this specific application—and even within other engineering-level projects in areas of dense vegetation—it should still be a perfectly viable solution.

2: Increased data accessibility

The other theme to highlight from this year’s Intergeo is the move to web delivery. Use of the cloud and web- based services is not new. What is interesting is the move towards what I will term “core data consolidation” platforms among the main vendors. When I use this term, I am referring to platforms that process and/or share data from multiple platform types, for delivery of information to meet project requirements. Both Trimble and Topcon launched their versions of such platforms at Intergeo.

Trimble’s Clarity

Trimble Clarity

In the case of Trimble, the Clarity cloud solution is designed to sit on top of Trimble Business Centre (TBC). TBC already provides a reputable and well-developed workflow for collecting and managing data, and producing deliverables from that data. Clarity provides the means for survey firms to share their deliverables with their clients in a manner that “reduces transfer times, and enables quicker and more informed decisions.”

Product manager Larry Rosenbalm’s presentation slickly demonstrated how panoramic and point cloud data could be streamed into a single web-based environment. From here, the user can annotate and measure. My personal impression is that users such as municipalities at an enterprise or corporate asset inventory level would be low-hanging fruit for Clarity.

Topcon Magnet Collage

Topcon MAGNET Collage web platform

As for Topcon, application specialist Andy Evans was busy demonstrating the MAGNET Collage web platform within a VR cave on Topcon’s stand—to a continuous line of visitors.

MAGNET Collage is the web delivery mechanism that accompanies the release of Topcon’s MAGNET Collage data processing and management platform earlier this year. Whether this was ever intended to offer a singular collection-to-delivery platform like TBC, what is clear is that Collage is very much focused on presenting a 3D-view of the world. It’s geared towards managing large and disparate sources of point cloud data, regardless of the platform that those data have been captured from (termed “mass data” in Topcon’s language).

In its descriptions, there is a emphasis on the extensive coordinate transformation library, together with tools for digitizing survey primitives. Viewed with the cave environment at Intergeo, it was also obvious how well data could be shared, streamed and rendered from the MAGNET Cloud Web platform across many types of device to make informed decisions. In Topcon’s case, the focus was on aligning information on infrastructure.

What do these platforms mean?

It will be interesting to see how both solutions might penetrate the market relative to survey-brand agnostic start-ups in this space, such as Pointscene from Finland. One might imagine that a survey firm may make a higher overall investment in a solution from one of the established players. What core platforms such as these do is keep existing users and extend the return on investment to users that already purchase from the vendor.

I am most curious to see how these types of solutions will step up beyond sharing point cloud or image data and making simple measurements. How will the variety of data products that a user of the web interface be increased, how can they get even more value from the platform? Will the vendors make additional types of data structure available? Will they develop application-specific tools? What types of integration will they add to connect with other cloud-based enterprise level solutions, such as those for project and document management on the construction site?

Conclusion

The geospatial user is spoilt for choice regarding the variety of sensors now available for 3D capture. Perhaps the question now refers to whether being fit-for-purpose is sufficient, or whether it will pay to be a specialist?

A second question: Is nicely presented data, or application specification deliverables worth the investment?