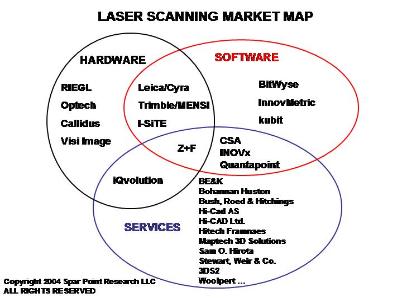

Laser scanning solution providers are pursuing every possible business model today – hardware/software/services, hardware/software, hardware/services, software/services, hardware

only, software only, services only. This is no surprise – most emerging information-technology markets look this way. But for anyone planning a laser scanning technology purchase, it’s a confusing picture. Which business models will foster growth and prosperity, and let providers invest in what’s important to you? Business models offer buyers valuable clues to how solution providers can be expected to focus their investments, today and tomorrow.Note: Many hardware manufacturers provide software that aids scanner operation, data collection, point-cloud registration and data export. However, in this analysis, “software” denotes standalone products for applications such as visualizing, navigating, partitioning and sectioning laser scan data, extracting geometric and/or feature intelligence, generating triangular meshes and surface models, combining laser scan data with photographs and/or data captured with other sensors, and serving laser scan data to other software products. “Services” may include scanning as well as point-cloud processing. Provider examples are representative, not exhaustive.

As the laser scanning industry matures, we expect the amount of overlap among these business areas will decrease – that is, solution providers active in multiple areas will narrow their focus. The most challenging model, we believe, will be to have major businesses in all three areas – hardware, software and services. More likely to endure are models where companies sell either hardware and services, or software and services – in other IT markets strong businesses have been built on both these models, though managing conflict with third-party service providers is not trivial. What seems virtually certain is that strong independent businesses will exist in each domain – software-only,

hardware-only, services-only.

Hardware/software/services monoliths – why not?

We believe few if any laser scanning companies will pursue a combined hardware/software/services model over the long term. The reason is the difficulty of allocating sales, marketing and development resources so as to optimize each of these three very different businesses. Indeed, the inherent internal and external conflicts of being in all three areas has driven many of the most successful companies in the IT industry to withdraw from one if not two of these areas.

For example, IBM and Hewlett-Packard are major providers of both hardware and services. Oracle, SAP and numerous other large, successful companies provide both software and services. Many prosperous companies focus solely on hardware, software or services. But significant IT providers with large, healthy businesses in all three areas – hardware, applications software development, and services – are virtually unheard of today.Combined hardware/software providers – what’s the outlook?

In the intermediate term, it’s somewhat uncertain how the market will respond to combined hardware/software businesses. Clearly, this model can offer customers the value of high confidence that a company’s software is optimized to work with its hardware. On the other hand, for any provider working to convince software developers to cooperate with its hardware business, conflict is inherent when its own software competes strongly with them.

How this conflict will be worked out in the laser scanning industry is not yet settled. In more mature IT markets, cases of a single company developing both substantial hardware and applications software are rare today. The CAD industry was established by companies that provided integrated hardware/software systems, but it evolved into a software-only business. On the flip side, computer makers IBM and HP at one time made major efforts in applications software development, but eventually exited this segment.

In cases where the hardware business and the software business was each viable in its own right, vendors sometimes resolved the conflict by separating the two assets into separate companies – a pattern that could be repeated in the laser scanning industry.

In particular, the case of IBM hints at one way the business models of laser scanning hardware providers could develop. Under former CEO Lou Gerstner the company exited the applications development business, and focused its software development exclusively on middleware and systems-level technology to augment the value of its hardware products (and its services business). If the laser scanning success in developing systems-level software that aids data acquisition and field data management. Those that also have robust, commercially successful applications software for using point-cloud data in engineering could eventually elect to resolve the conflicts discussed above by separating that business line into a separate entity.Technology breakthrough based on tight hardware/software coupling would be a winner

On the other hand, it is conceivable that a technology breakthrough could come about that requires tight integration between scanner hardware, data acquisition software and data processing software. If the

technology was compelling enough, that would be a highly robust business model.

If laser scanning were a vast commodity market, this scenario would be unlikely. But given that these are relatively early times in laser scanning technology development, it could emerge that a tight coupling between hardware and software development is a decisive strength. Even if the endpoint of the industry’s evolution is almost no intersection between hardware, software and service providers, but instead vibrant independent actors in each domain, nevertheless there may be a considerable period when coupled business models are needed for the industry to advance.

We believe it’s too early to call the outcome. But we can say that unless there’s a compelling breakthrough based on tightly coupled hardware, data acquisition software and data processing software – one that makes sense for the vertical markets with the most purchasing power – then for the industry as a whole, the average number of business areas covered by a single provider is likely to decrease.Hardware/services, software/services – will these models succeed?

Business models that combine hardware and services, and those that combine software and services, have proven robust in other IT markets. The world’s major computer manufacturers own some of the world’s largest IT service organizations. Likewise, top global software companies have built substantial service businesses around their products.

In the laser scanning industry, services provided by either hardware or software companies can appeal to customers that lack scanning or point-cloud management expertise or resources. For providers, services are useful in getting a product business launched, building customer relationships and staying in touch with customer needs.

But for a product company to add services to the mix is not without challenges. Convincing service providers to use a company’s products while its own service arm competes with them is tricky. It can be done, but it requires advanced business management skills and resources. For example, IBM provides services directly to customers, and also engages independent business partners to provide services around its products. However, this requires sophisticated channel management and account management capabilities – careful allocation of resources between direct and indirect activities, regular meetings with business partners to negotiate which opportunities belong to each side, ongoing

management of channel contention.

So it can be done, but managing it over the long term requires a set of business skills – and clout with partners – that the laser scanning industry has yet to develop.

Hardware-only, software-only, services-only providers likely to do well

What seems virtually certain is that strong independent businesses will exist in each domain – software-only, hardware-only, services-only. Focusing on just one area greatly simplifies the management burden and avoids the conflicts likely to result from mixed business models.

Of course, for companies active in only one business area, a challenge is to strike enough partnerships to get traction – for example, software-only companies need to partner with many if not most scanner manufacturers, with the major CAD vendors, and with many scanning service providers. But companies pursuing just one business area today seem able to do this, providing they can make a convincing case for their value and differentiation.

Another trend we expect is that specialty software applications tailored for the needs of particular sub-markets will emerge from companies in all three areas – hardware manufacturers, software developers and service providers. Indeed, this is happening today, and we expect it to continue. Where this has happened in other IT markets, these products have generally helped their developers gain recognition and acceptance among the customers targeted.For practitioners, what would be ideal?

For practitioners, the ideal case would seem to be a market populated by (1) competing hardware companies whose data can be used by all the leading software products, (2) competing software companies whose products accept output from all the leading hardware systems, and (3) service providers that can mix and match best-of-breed hardware and software for each customer’s situation. But we’re a long way from that today. Indeed, if other IT markets are any guide, this situation may

never be reached. For now, best practice is simply to buy the hardware that meets your needs, while making sure you have access to the software that best supports your work processes.

For service providers, the decision is more complicated. Buy the best hardware compatible with the software that supports your customers’ work processes – but if the supplier of any of this technology competes with you, that may not be the best business decision. In fact service providers must balance optimality of hardware and software against sustainable business relationships with technology providers that don’t compete with them and, in the best of cases, send them business.

Watching how suppliers manage their business models is one of the best ways to anticipate which ones are most likely to focus their investments on your needs.